The Rise of AI Financial Advisors: Are Robo-Advisors Better Than Humans?

Personal finance exists in a world experiencing the fastest pace of transformation in human history. Traditional financial advisors have served Americans for many years by helping individuals create retirement plans, make informed investment choices, and build long-term financial assets. The last decade has brought a total revolution to this field through technological advancements. The first innovation brought robo-advisors, which provided automated investment services at affordable prices. The current economic revolution brings AI financial advisors, who use machine learning and real-time analytics to create personalized economic choices for each individual.

The United States’ transition to Fintech innovation and digital financial planning creates an essential question about whether AI financial advisors perform better than human advisors. The everyday investor needs to understand what these market trends will do to their investment portfolio.

Let’s explore.

Table of Contents

The Evolution of AI Financial Advisory in the Age of AI

The financial industry operated with individualized human interaction as its core service before technology transformed the sector. Traditional financial advisors developed their strategies through their combined experience and market understanding, and their ability to obtain insights through direct client conversations.

The services proved successful, but their high costs made them unavailable to people under thirty and those who earned low incomes. The 2010s brought robo-advisors, which provided users with basic algorithm-based systems that automatically built investment portfolios and maintained their asset proportions. The platform enabled millions of Americans to start investing through its user-friendly interface, thereby reducing investment requirements.

The industry continues its progress into the present day. The current financial platforms employ AI-based financial planning systems, which provide advanced features that surpass the basic functions of initial robo-advisory systems. AI financial advisors use machine learning to analyze large data sets, which enables them to generate predictions and risk evaluations, and investment portfolio recommendations at speeds that exceed human capabilities. The increasing number of investors who want affordable, customized investment solutions has led to the expanding use of automated wealth management systems that incorporate artificial intelligence technology.

What Are AI Financial Advisors and How Do They Work?

While robo-advisors offer automated investing through pre-built algorithms, AI financial advisors go further.

What makes AI advisors different?

- They learn from data over time.

- They adjust to changing market behavior in real time.

- They analyze your spending, goals, and risk tolerance with far greater accuracy.

- They adapt as your life circumstances evolve.

AI investment platforms analyze extensive financial data through machine learning models and predictive analytics to generate advanced investment recommendations based on market trends and consumer behavior patterns.

How AI Financial Advisors Operate

The research collects financial data, including income statements, expense records, credit score information, savings behavior, and target objectives.

- Portfolio modeling involves algorithmic trading and real-time allocation to optimize asset distribution, manage risk, and maximize returns.

- The system performs continuous optimization through automated market signal-based rebalancing operations.

- Risk monitoring involves detecting market volatility in real time and instantly adjusting investment positions to minimize losses and protect returns.

Here are some examples of AI tools that can be used for financial advisory services

1- Betterment – With 300,000 clients, Betterment is the best known of the robo-advisors. The company in question is a leading online financial services provider.

The service can offer clients automated data analysis as well as tailored investment advice through its sophisticated computerized systems.

Everyone can access affordable wealth management with Betterment, regardless of their level of investment experience, whether a newcomer or an experienced investor.

The company provides easy-to-use investment solutions. These solutions are reasonably priced and are accessible to everybody. This includes both new and seasoned investors. The company Betterment uses algorithms to customize a client’s investment portfolio according to the client’s personal financial goals, risk tolerance, investment timeframe, and current financial status. Upon registering, the programme gathers crucial information such as earnings, savings, and investment objectives. Having a comfort zone in relation to market fluctuations is important. With Betterment, portfolio investments are automatically managed by their technology. The investments are low-cost ETFs and are spread across a variety of different stock and bond markets.

2- Wealthfront- With its automated investment management, Wealthfront utilizes the latest technology to assist people in managing their financial portfolios. Robo-advisors are typically utilized by individuals who prefer not to learn intricate investment strategies. The service requires information on income, risk tolerance, and goals before you can open an account. It enables investors to create a diversified investment portfolio by investing in several types of assets.

Investments are constantly tracked and automatically adjusted to meet your objectives. These kinds of accounts also reduce taxes through a process known as tax-loss harvesting. This allows a lower tax bill by selling investments that have decreased in value.

Wealthfront offers retirement planning, savings accounts, and other financial tools. With the system now online, customers do not need to communicate with a financial advisor. This application is very cost-effective and also simple to use.

Investors who are either just starting with their investment portfolio or who are time-poor could suitably make use of the Wealthfront automated service. It can automatically manage investments efficiently using computer algorithms.

3- “i”Genius – “i”Genius is a data-based system that provides decision support to financial professionals through data analysis and can generate predictions from the data. The system provides very fast processing of large volumes of financial information.

With its ability to comprehend everyday language, the query tool lets you ask business questions in regular English, such as ‘What were sales like last quarter?’. iGenius processes information from a range of sources to provide understandable results in a neat and clear presentation.

Financial institutions and major corporations use this type of analysis in order to understand market trends, risks, and company performance. By automating manual data analysis, employees can obtain quicker insights through the use of AI.

“i”Genius is an intelligent tool that saves you time, lowers your error count, and enables better decision-making. Businesses employing this solution typically find that it is particularly helpful for non-technical managers wanting rapid access to information.

4- Nitrogen –A risk management tool that incorporates AI is available to financial advisors. It tool is called Nitrogen, and it is capable of measuring a client’s risk attitude. It enables financial advisors to put together appropriate client portfolios.

The intention is to make risk assessments based on verifiable information rather than assumptions, so as to enable informed investment choices.

Using sophisticated data analysis and AI-driven predictive techniques, the site evaluates investment strategies and portfolio potential under conditions including economic downturns, unexpected economic events, and periods of heightened market volatility.

Nitrogen’s simulations offer the ability to model real-world market events so investors can see firsthand the potential effects of various market risks before they make any investment decisions.

Nitrogen has a distinct approach to problems that relies heavily on visualization. Interactive visual aids such as charts and graphs can be used by the advisors to better explain complex risk concepts to their clients. With this data to hand, clients can better understand their investment, its potential reaction to market fluctuations, and whether the strategy suits their risk profile.

The manufacture of semiconductors relies heavily on nitrogen to ensure compliance with the required standards. A compliance and risk tool helps financial advisors by allowing them to keep and review client records of risks and consents. This can help them in managing their paperwork and in complying with regulatory requirements. Financial institutions can build trust with investors through their online platforms by providing AI-generated information that helps to give greater clarity and transparency to investor decisions.

5- QuantConnect- Developed with a strong focus on the needs of algorithmic traders, QuantConnect is a trading platform that is driven by the power of artificial intelligence.

This platform is tailored towards financial professionals, traders, and developers who wish to build, test, and deploy completely automated trading strategies.

Algorithm development and backtesting are facilitated in a highly efficient trading environment. A number of developers who use this system use C# and Python. Therefore, it is suitable for both beginners who have not yet learned to code and for developers who have years of experience.

Built on a large and active community, QuantConnect’s open source algorithmic trading platform offers access to historical data for multiple asset classes, including equities, cryptocurrencies, futures, forex, and options.

This data can be used by investors to back-test trading strategies in real-time market conditions before they start trading with real capital. By doing so, the risk involved is reduced, and the investor can achieve his/her objectives with his/her portfolio.

QuantConnect also allows users to integrate their own machine learning or artificial intelligence algorithms. While advanced users are able to refine predictive models to achieve optimization of strategies and adaptation of algorithms, they must be able to react to changing market trends. This makes the system particularly valuable for the development of complex AI-driven trading systems.

Quantitative traders and hedge funds use QuantConnect extensively for executing and back-testing various trading strategies. Financial students are also using the platform as a learning tool. Beginners benefit from the platform’s open source software, active community, and its comprehensive tutorial, which allows for incremental learning about trading algorithms. Quantconnect allows traders to put trading strategies into effect quickly and efficiently with their high-performance, algorithmic trading platform.

6- Sentieo – For investment professionals, Sentieo is a research platform powered by AI. Financial research can be sped up by this software for investors and analysts. Powered by AI, the system automatically reads and interprets key financial documents such as earnings calls, company reports, and SEC filings. Users can quickly locate relevant data via a simple keyword search function. Their analytical platform includes a range of features to make data more visual and therefore easier to understand. The information contained in lengthy documents can be compressed by the use of a summary. Financial analysis tools like this one enable investors to make well-informed investment decisions through the automation of time-consuming processes. Many institutional investors make use of a financial website. This includes hedge funds, asset managers, and stock analysts.

7- Kensho –Kensho, a data analytics platform that is powered by AI, is utilized primarily by the government and the finance industry. The software can sift through massive datasets of any complexity in order to supply useful information.

Kensho is used by a number of firms in order to see the economic impact of various events on markets. The system can provide answers to such questions as how economic markets respond to elections, changes in government policy, shifts in interest rates, and foreign events. The data is analyzed by Kensho’s algorithm, which looks for trends or patterns that may not be immediately obvious to a human investor or financial analyst. Such systems allow for better strategy development by means of predicting potential outcomes.

Large corporations can particularly benefit from the use of Kensho as they continually process large amounts of data. Kensho saves professionals time and effort by quickly providing critical information that would otherwise require research and analysis.

Automating the work increases efficiency and decreases the likelihood of errors.

By giving users straightforward, data-based responses, the platform assists in strategic decision-making.

Financial institutions make use of computers in order to analyze market trends, to assess risk, and to conduct research into investment opportunities.

It is used by government bodies to research and understand economic patterns and the effects of government actions. iKensho’s AI capabilities simplify complex data and information, enabling faster and more intelligent decision-making processes within an organization.

8- Empirica Robo Advisor -Empirica Robo Advisor is an AI-based investment advisory platform that helps people invest their money in a smart and automated way.

It is designed to manage investment portfolios using data, algorithms, and predefined rules, rather than relying on human emotions.

This makes investing more disciplined and consistent. The platform studies market trends, asset performance, and risk levels to suggest suitable investment strategies. It also considers the user’s financial goals, such as long-term growth or steady returns. Based on this information, Empirica automatically builds and manages a portfolio that matches the investor’s needs.

One of the biggest benefits of Empirica Robo Advisor is that it removes emotional decision-making. Many investors make mistakes by reacting to market ups and downs. Empirica follows a data-driven approach, which helps avoid panic selling or overconfidence. Its is useful for individual investors who want a hands-off investing experience. It is also used by financial institutions to offer automated advisory services to their clients. The platform provides consistent, rule-based portfolio management with minimal human involvement. Overall, Empirica Robo Advisor offers a structured and reliable way to invest using AI. It helps investors make smarter financial decisions while saving time and effort.

9- Zocks – Zocks is an AI-powered tool created to help financial advisors manage their clients more efficiently. It focuses on saving time by automating routine tasks related to client meetings and documentation. Instead of writing notes manually, advisors can rely on Zocks to do the work for them. The AI listens to client meetings, whether they are online or in person, and automatically creates clear summaries. It captures important discussion points, action items, and follow-up tasks. This reduces the chances of missing key details and improves accuracy in record keeping. Advisors no longer need to spend hours updating notes after every meeting.

Zocks also integrates easily with CRM systems. This means all client information, meeting notes, and tasks are stored in one place. It helps advisors keep client data organized and up to date without extra effort.

By reducing paperwork and manual data entry, Zocks allows financial advisors to focus more on building relationships with their clients. Overall, Zocks improves productivity, reduces stress, and enhances the client experience in financial advisory services by making client management faster and smarter.

10- Jump AI – Jump AI is an AI-powered platform designed to help financial teams work faster and smarter. It helps businesses analyze large amounts of financial data and automate daily tasks that usually take a lot of time. By using AI, Jump AI reduces the need for manual work and improves overall efficiency.

The platform can process large datasets quickly and turn raw data into useful insights. It helps finance teams understand trends, track performance, and identify risks. Jump AI also supports better decision-making by providing clear and accurate reports. This allows teams to focus more on strategy instead of spending hours on data analysis.

Jump AI is commonly used by finance teams, analysts, and large enterprises. It is useful for companies that deal with complex financial data and need fast, reliable results. The tool can automate reporting, forecasting, and workflow management, which saves time and reduces errors. Overall, Jump AI helps businesses make faster, data-driven financial decisions. By using AI to handle routine tasks, companies can improve productivity, accuracy, and efficiency in their financial operations.

The AI-based services unite automated systems with advanced predictive analytics, which enable wealth management to deliver customized services at unprecedented levels of responsiveness.

The Rise of Robo-Advisors in Modern Finance

The worldwide Fintech industry has experienced a total revolution because of robo-advisory services. The U.S. robo-advisors industry now manages more than $1 trillion in client assets, while experts predict this figure will grow quickly because Generation Z investors choose automated investment solutions.

Why are robo-advisors so popular?

- Low fees: Most charge between 0.25%–0.50%, compared to 1%+ for human advisors.

- Ease of access: Anyone with $1–$500 can start investing.

- Automation: Emotional decisions, just algorithmic precision.

- Digital-first experience: Perfect for investors who prefer mobile and online tools.

The digital wealth management industry has become accessible through robo-advisors, but platforms now use artificial intelligence to enhance portfolio optimization because customer needs have grown more complex.

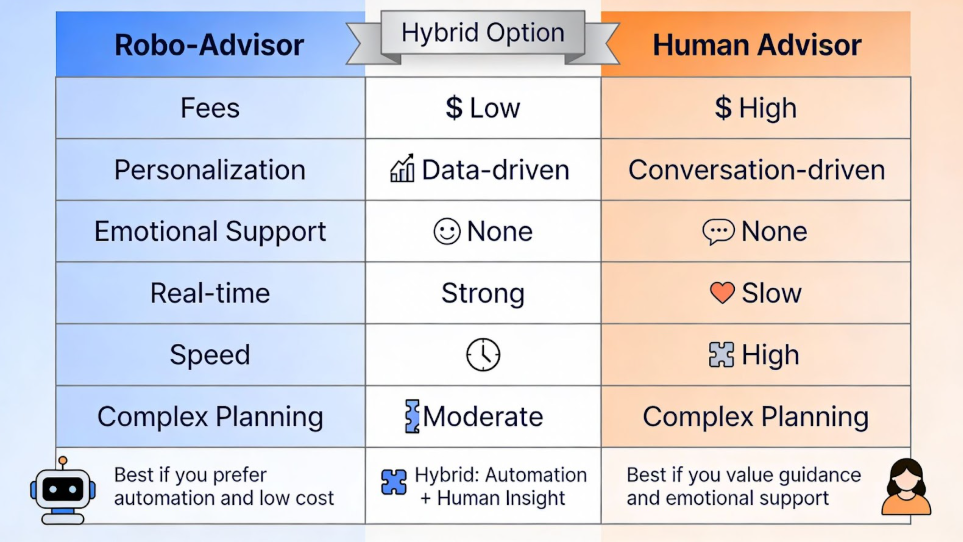

Robo-Advisors vs. Human Financial Advisors: A Comparative Analysis

Your investment decision between an AI-based platform and a human advisor should consider your financial targets and funding capacity, and your ability to work with automated systems.

The following information presents a detailed analysis of the data.

1. Cost Efficiency

- Robo-advisors: Low-cost, automated, ideal for beginners.

- Human advisors: Higher fees, but provide hands-on guidance and emotional support.

2. Personalization

AI advisors deeply analyze data to create hyper-personalized strategies. Humans rely on conversation and experience. Both can be effective; AI is more data-driven, and humans are more intuitive.

3. Emotional Intelligence

This is where humans shine. If you panic during a market crash, a human advisor can help you stay calm. AI cannot provide emotional reassurance.

4. Decision-Making

AI financial advisors process information instantly. Humans take longer but can factor in emotional, personal, and life-driven nuances beyond numbers.

Quick Comparison Table

Category | Robo-Advisor | Human Advisor |

| Fees | Low | High |

| Personalization | Data-driven | Conversation-driven |

| Emotional Support | None | Strong |

| Speed | Real-time | Slow |

| Complex Planning | Moderate | High |

A growing number of Americans are opting for hybrid models, getting the best of both automation and human insight.

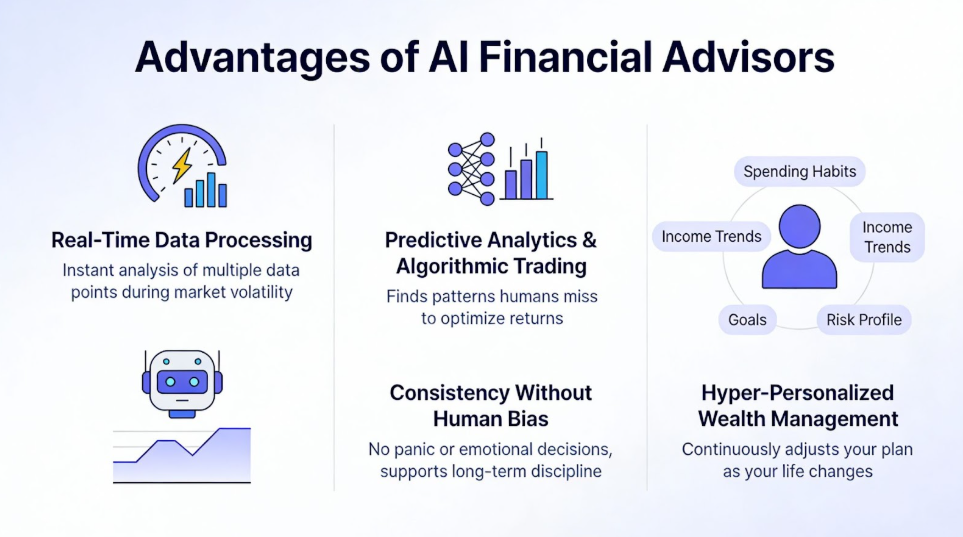

Advantages of AI-Powered Financial Advisory

AI financial advisors bring a new level of sophistication to automated investment management.

1. Real-Time Data Processing

Unlike humans, AI systems analyze multiple data points instantly, helping investors adjust portfolios during market volatility.

2. Predictive Analytics & Algorithmic Trading

AI identifies market patterns invisible to human advisors. This helps optimize returns using algorithmic trading strategies.

3. Consistency Without Human Bias

AI does not panic, get emotional, or make irrational decisions. This improves long-term investment discipline.

4. Hyper-Personalized Wealth Management

AI studies:

- Your spending habits

- Your income trends

- Your financial goals

- Your risk profile

and continuously adjusts your investment plan as your lifestyle evolves.

This level of personalization is something even the best human advisors can struggle to match.

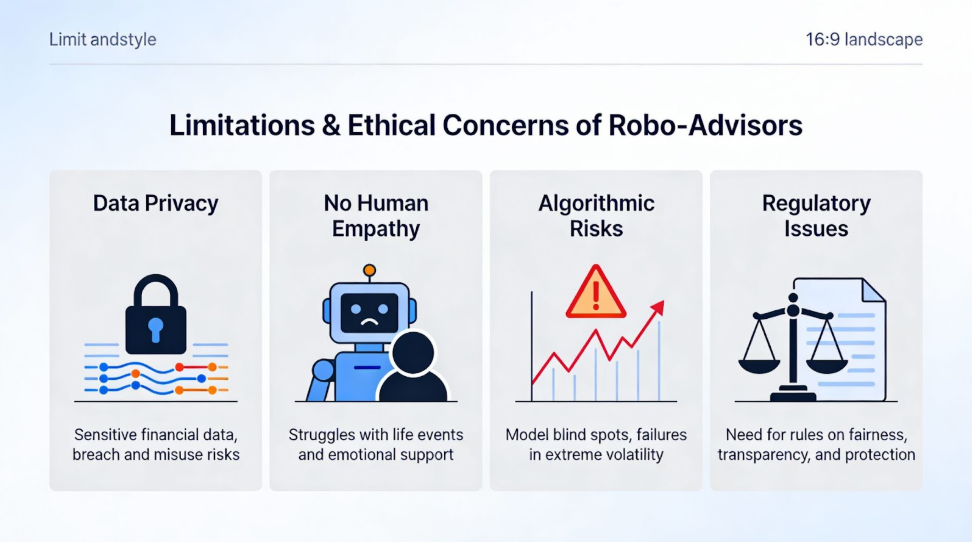

Limitations and Ethical Concerns of Robo-Advisors

Despite their benefits, AI financial advisors have important limitations.

1. Data Privacy Concerns

AI platforms rely on sensitive financial data. U.S. investors express concerns about data breaches and algorithm misuse, and insufficient disclosure regarding algorithm operation methods.

2. No Human Empathy

AI systems cannot recognize individual personal challenges and emotional responses that people experience.

People need human assistance to handle their most important life changes, which include getting married and getting divorced, and receiving an inheritance.

3. Algorithmic Risks

All algorithms have blind spots. An AI model might misinterpret market signals or fail during extreme volatility.

4. Regulatory Issues

The increasing influence of AI in financial decision-making requires regulators to establish rules that will protect consumers while maintaining both fairness and transparency in financial operations. The financial industry benefits from AI technology, yet requires proper management of its operational use.

The Future of Financial Advice: Hybrid Models and Human–AI Collaboration

The future of wealth management in the U.S. is not about choosing between humans or technology; it’s about leveraging both.

Hybrid financial advice models combine:

- AI automation for investment execution

- Human expertise for personalized guidance

The method provides investors with:

- Lower fees;

- Expert advice availability;

- More accurate portfolio strategies;

- A balanced emotional + analytical approach;

Human advisors will transform instead of vanishing when AI systems reach higher levels of sophistication. The future work of these professionals will focus on developing strategies and providing emotional backing and complete financial planning, but AI systems will perform all data processing tasks. AI systems will work together with human advisors to improve their performance instead of taking their place.

Conclusion: Finding the Balance Between Technology and Trust

The conversation between AI financial advisors and human financial advisors examines their separate advantages instead of trying to establish which system produces superior results.

AI excels at:

- Fast decision-making;

- Data-driven optimization;

- Low-cost investment management;

Humans excel at:

- Emotional intelligence

- Complex financial planning

- Trust-based relationships